39 Governance of the Mitsui Zaibatsu

Centralized Control through Mitsui Gomei Kaisha

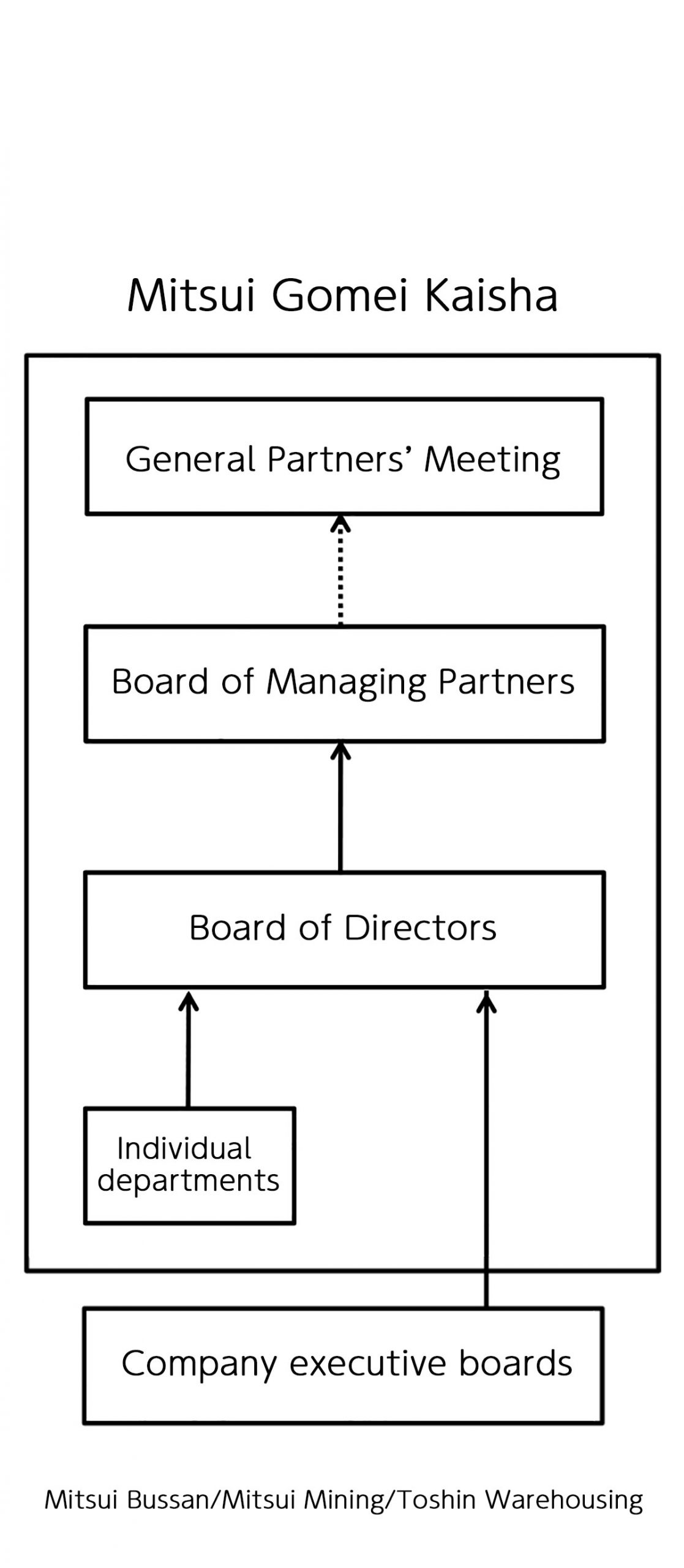

The Mitsui zaibatsu shifted to a pyramidal management structure when the Mitsui family set up a family-controlled holding company, Mitsui Gomei Kaisha (Mitsui Partnership Company), to control subsidiary companies. Each of these subsidiary companies was a leader in its field and helped solidify Mitsui zaibatsu’s prominent position within Japan’s economy. One key difference between the prewar zaibatsu and postwar corporate groups was the level of control the zaibatsu’s head company held over its subsidiaries. In addition to other measures, Mitsui Gomei Kaisha used five key mechanisms to control its subsidiaries. Subsidiaries had to (1) submit reports on their executive board meetings, (2) report their business performances before their general shareholders meetings, (3) submit reports on their financial activities, (4) allow Mitsui Gomei Kaisha to assign personnel for their top managerial posts and (5) obtain prior approval before appointing any of their own executives or managers. The zaibatsu adopted a management structure that used reporting requirements, managerial appointments, and other mechanisms to strictly control the operations of its subsidiaries.

Review and Approval Protocols for Important Decisions

Among the subsidiaries of Mitsui Gomei Kaisha, Mitsui Bussan, Mitsui Mining and Toshin Warehousing were subject to comparatively stronger controls. The Mitsui zaibatsu instituted a review procedure to approve certain decisions, and any important decisions these three companies made during executive board meetings were submitted to Mitsui Gomei Kaisha for review as “tentative” decisions. Other decisions could be treated as final decisions and were merely reported to Mitsui Gomei Kaisha. The “tentative” important decisions only became official decisions after Mitsui Gomei Kaisha had reviewed and approved them.

Most of the tentative decisions the subsidiaries submitted to Mitsui Gomei Kaisha were approved without further changes. However, this does not indicate that the reviews at Mitsui Gomei Kaisha were merely a formality. Instead, it likely indicates that tentative decisions were submitted only after they had been adjusted to reflect prior negotiations between the subsidiaries and the heads of Mitsui Gomei Kaisha.

Mitsui Gomei Kaisha did not apply these decision-making controls to its three financial companies: Mitsui Bank, Mitsui Trust and Mitsui Life Insurance (though presumably did apply them to Mitsui Bank until it was listed in 1919). Toshin Warehousing was later exempted from decision-making controls when Mitsui Gomei Kaisha sold its shares in the subsidiary to Mitsui Bussan in 1938.

Decision-Making Procedures at Mitsui Gomei Kaisha

The highest decision-making body in Mitsui Gomei Kaisha was the General Partners Meeting, which was made up of the heads of the 11 Mitsui families. However, the meeting was only convened a few times a year and its scope was extremely limited, handling such matters as the establishment of new affiliate companies, important personnel decisions, and financial matters for Mitsui Gomei Kaisha. All matters outside of this scope were handled by the Board of Managing Partners, a body comprised of three to four members of the Mitsui family.

In August 1914, Mitsui Gomei Kaisha created the post of chief director and appointed Dan Takuma to fill it. This was part of a larger management and personnel restructuring effort that had been triggered by the Siemens Scandal (a bribery scandal concerning the construction of the battleship Kongo). In 1918, Mitsui Gomei Kaisha established a Board of Directors (comprised of professional managers) as a body to discuss proposals and other important matters submitted to the Board of Managing Partners. Later, the Board of Directors came to hold the actual substantive decision-making authority for Mitsui Gomei Kaisha (and by extension, the Mitsui zaibatsu), as the Board of Managing Partners took on a more perfunctory role in approving the decisions reached by the Board of Directors. The Board of Directors also reviewed important decisions submitted by subsidiaries (→Fig. 39c).

The Role of the Mitsui Family

The Mitsui family were the zaibatsu’s owners and held key roles within its governance structure. As the sole shareholders of Mitsui Gomei Kaisha, the Mitsui family were also the exclusive members of its highest decision-making body, the General Partners Meeting. Those with the highest authority sat on the Board of Managing Partners and were involved in business decisions. Family members were also appointed to executive positions in subsidiaries (e.g., president, executive or auditor). Until early 1934, the presidents of Mitsui Bussan, Mitsui Bank and Mitsui Mining as well as several other executives were all members of the Mitsui family.

Mitsui family members occasionally voiced strong objections to important policy and personnel decisions, both officially and unofficially. Although the Mitsui zaibatsu was known for placing professional managers in top posts rather than family members, those managers were still obliged to take the wishes of family members into consideration.

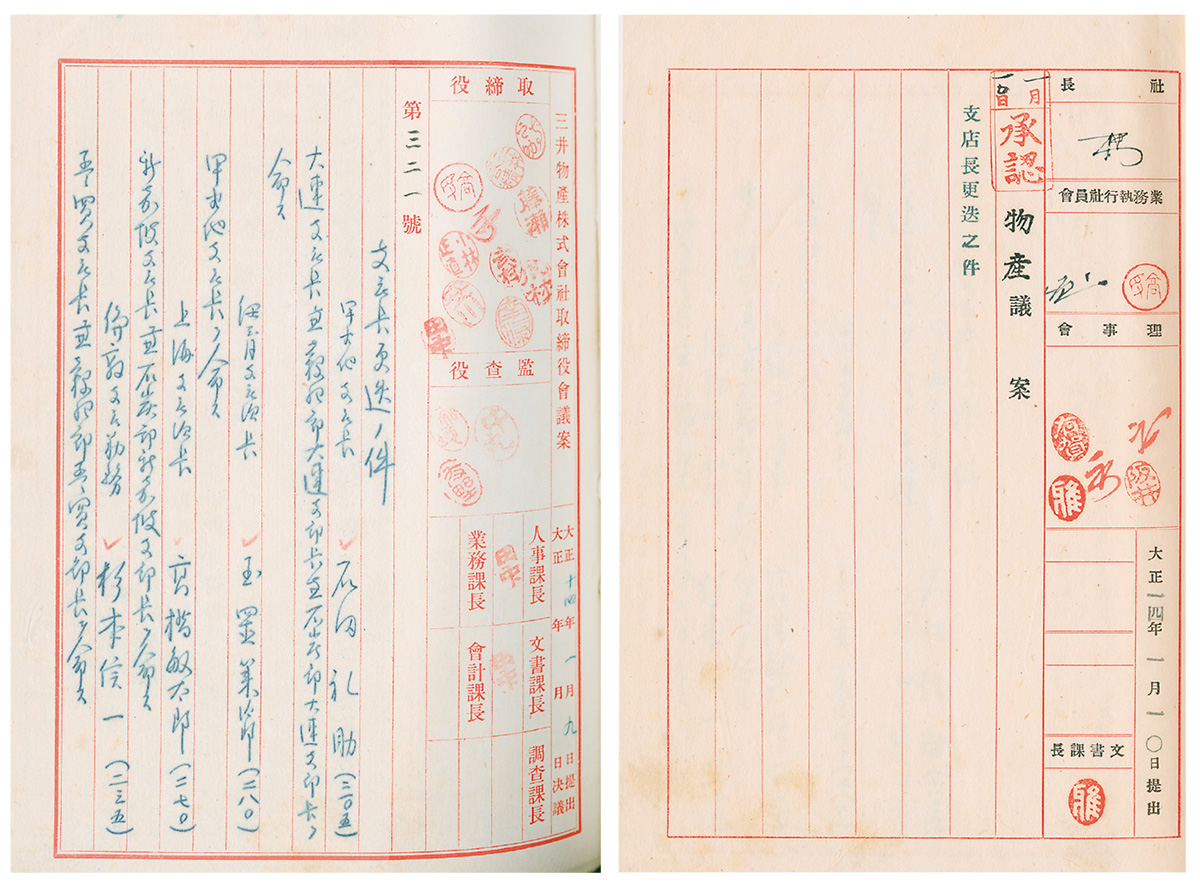

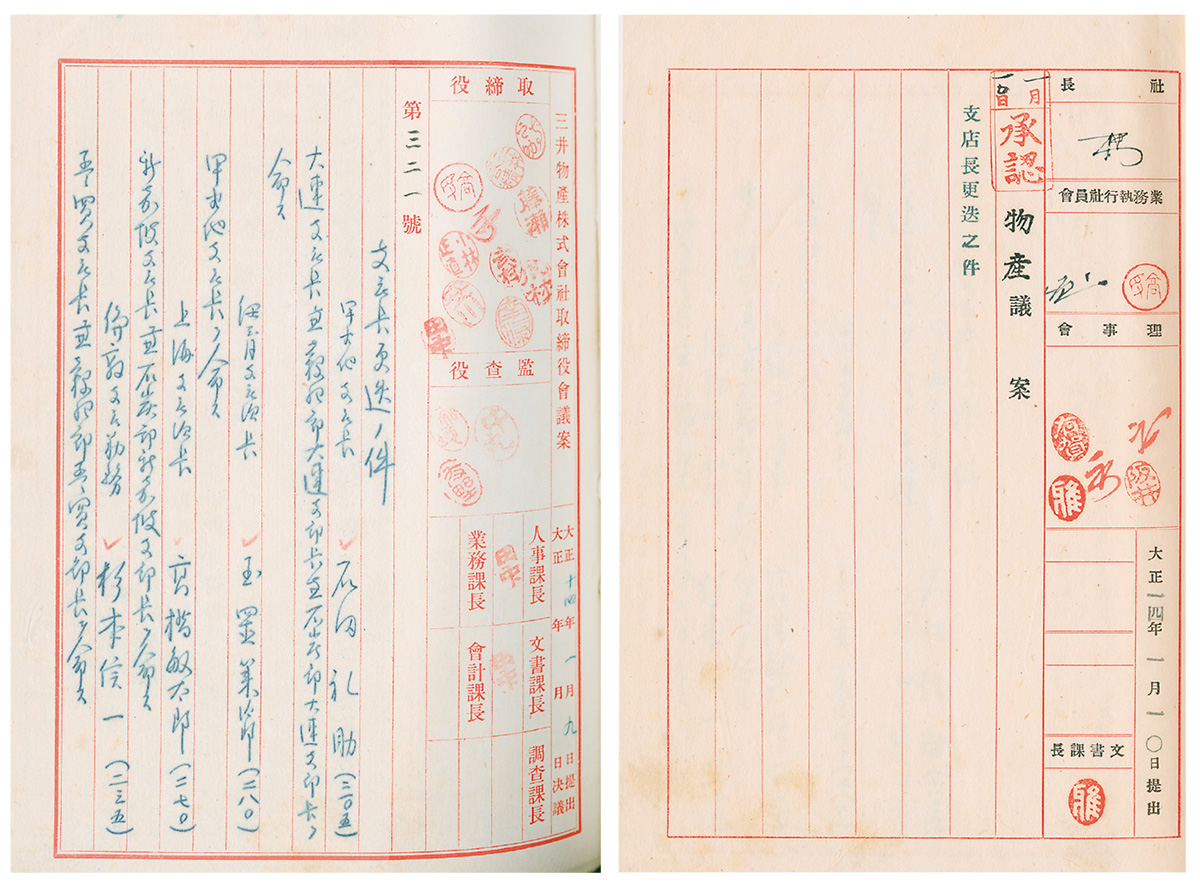

Important decisions made during Mitsui Bussan’s executive board meetings required approval from Mitsui Gomei Kaisha. In the 1920s and 1930s, close to 60% of the decisions made by Mitsui Bussan’s executive board were important enough to send to Mitsui Gomei Kaisha. Their topics were wide-ranging and included: all personnel decisions for positions higher than store manager, start-up expenses, establishing new affiliates, donations, accounting matters, and the revision, enactment, or abolishment of company regulations. The tentative personnel decisions shown here include one concerning the transfer of Ishida Reisuke-who would later rise to the top of Mitsui Bussan-from his post as branch manager in Calcutta, India, to branch manager in Dalian, China. The image to the left is the tentative decision from Mitsui Bussan’s executive board, and it bears the seals of all the executives below the president, but this would not have made it a final decision. The image to the right is a procedural slip for Mitsui Gomei Kaisha that was attached at the time of submission. It bears the seal of approval of the president of Mitsui Gomei Kaisha, Mitsui Takamine, as well as the stylized signature seals of the chief director Dan Takuma and other managers.

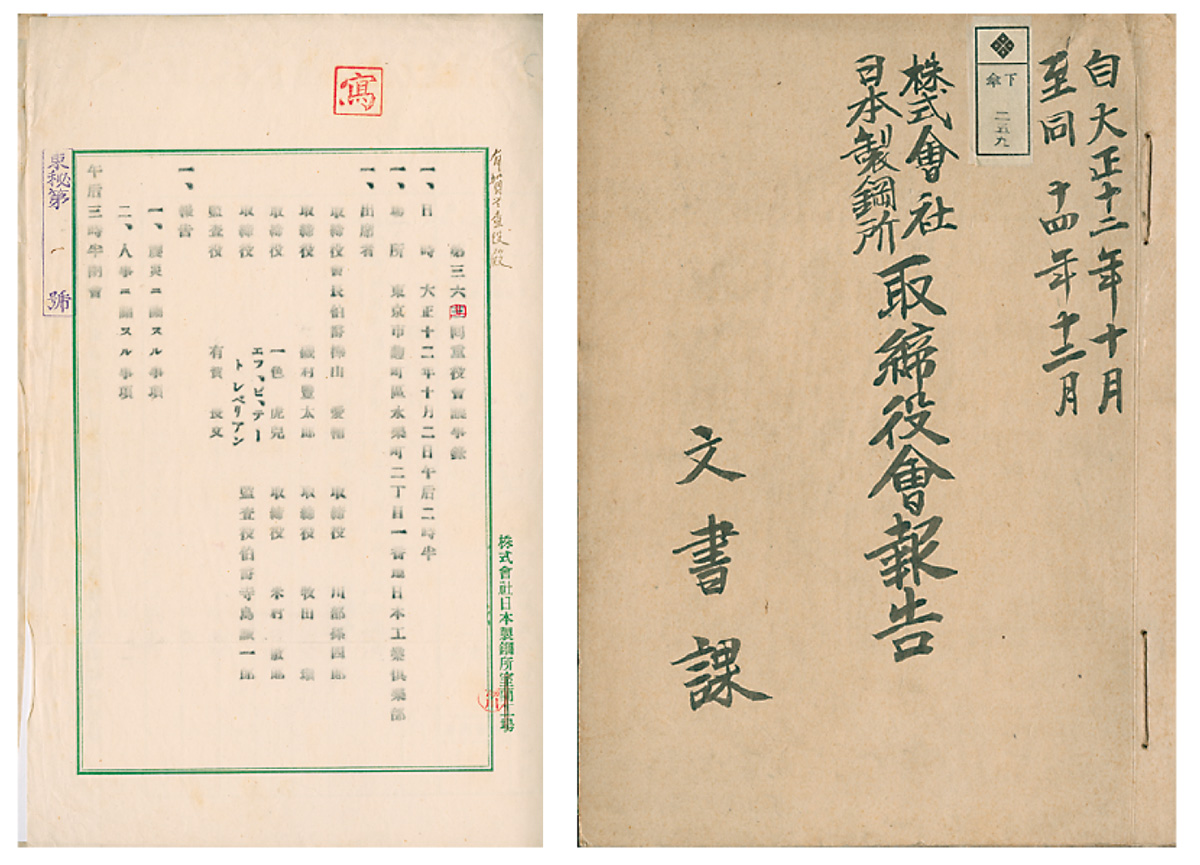

Hokkaido Colliery & Steamship (a subsidiary of Mitsui Gomei Kaisha) was the largest shareholder of Japan Steel Works, but Mitsui Gomei Kaisha also held shares directly. Japan Steel Works submitted reports to Mitsui Gomei Kaisha for every meeting of its executive board. Prior approval from Mitsui Gomei Kaisha was also required to finalize financial statements. Japan Steel Works was an important subsidiary for Mitsui Gomei Kaisha, as it was one of the few heavy industry firms under the holding company’s umbrella.