46 Launch of Teikoku Bank

“Policy of Few Branches”

In the 1920’s, under its conservative business strategy, Mitsui Bank maintained a policy of having only a small number of branches. Rather than focusing on deposits from the public, the bank prioritized securing large-scale deposits primarily from companies, and its lending too was directed toward major corporations in urban areas. While deposits from Mitsui’s own direct affiliates grew, demand for funds was low during the economic downturn, leaving the bank with a significant surplus of funds and a focus on stable management. As a result, following the financial crisis of 1927, when deposits became concentrated in zaibatsu-affiliated financial institutions, deposits at Mitsui Bank were struggling to grow relative to other banks. By 1933, it had fallen to fourth place in deposits, behind Sumitomo, Daiichi, and Yasuda.

Shift to a Branch Expansion Policy

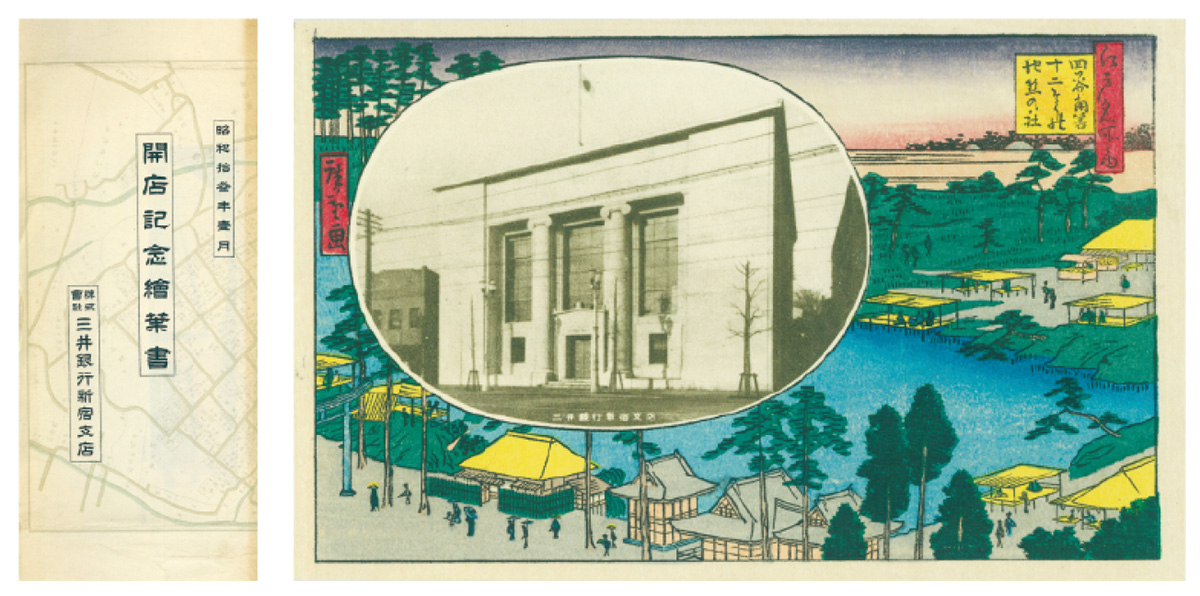

Into the 1930s, Mitsui Bank shifted its business strategy, expanding the number of branches to attract deposits from the public while venturing into financing for small and medium-sized businesses, which carried a higher risk of default. The first such attempt was with its Shinjuku branch, which opened in 1938 (→Fig. 46b). With the outbreak of the second Sino-Japanese War, demand for funds surged, particularly among Mitsui-affiliated companies, prompting the bank to continue opening branches in Tokyo, including in Ikebukuro, Meguro, and Gotanda. However, as other banks were also increasing their own branch numbers, Mitsui Bank, having been late to branch expansion, saw its deposit volume fall even further behind other major banks.

Merger Concept

In 1938, facing a decline in its fund-raising capacity, Mitsui Bank began conceiving of a merger with Dai-Ichi Bank (formerly First National Bank). At the time, under government guidance, regional banks were being merged and consolidated to help absorb deficit-covering government bonds and address an increasing wartime demand for funds. Against this backdrop, Mitsui Bank Chairman Mandai Junshiro anticipated that fixed-rate lending under government control would, in the future, lead to worsening profitability. He believed the bank should move away from operations focused primarily on large-scale transactions and instead work to expand small-scale transactions in an effort to strengthen the bank’s revenue base. Consequently, he drafted a plan to merge Mitsui Bank with another major bank.

In order to realize this plan, Mandai consulted with Ikeda Seihin (→45 ) and, with his help, succeeded in obtaining the consent of the eleven Mitsui families to the plan for a merger with Dai-Ichi Bank, which he had conceived himself. Although initially rejected by Akashi Teruo, the president of the First National Bank, by around 1940, controls over fund management were being strengthened, and large banks capable of investing significant funds in wartime industries were increasingly being sought. As a result, the issue of a merger between the two banks gradually gained feasibility.

Establishment of a New Bank

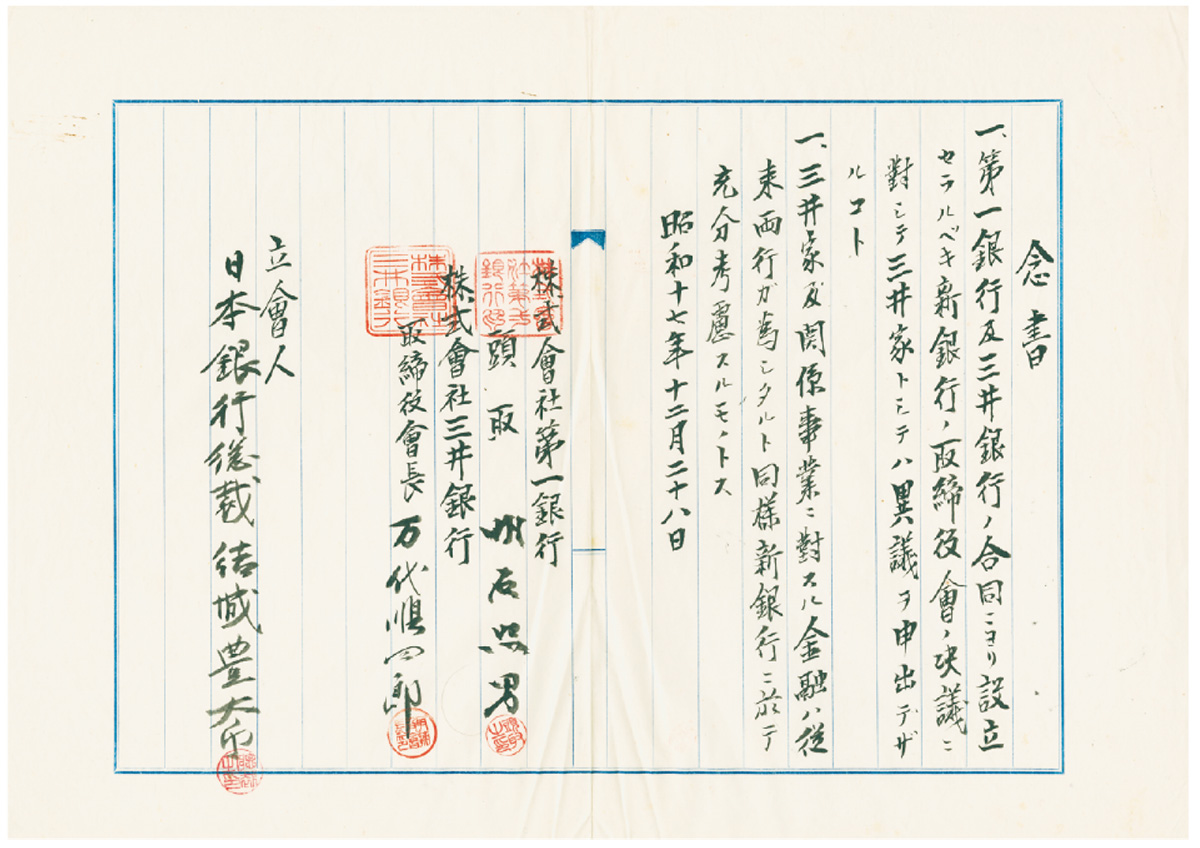

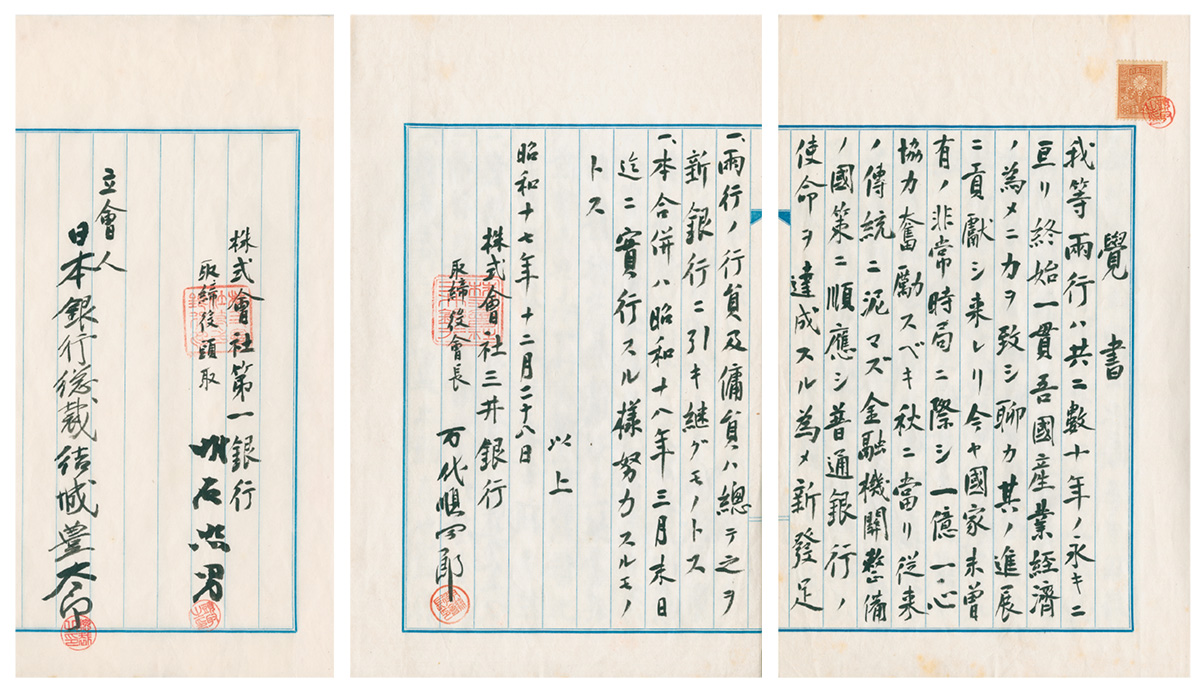

On December 17, 1942, when Mandai Junshiro visited Bank of Japan Governor Yuki Toyotaro, the proposed merger with Dai-Ichi Bank resurfaced. On December 22, Mandai and Akashi held discussions, mediated by Bank of Japan Deputy Governor Shibusawa Keizo (the grandson of Shibusawa Eiichi, president of the First National Bank). A few days later, the basic terms of the merger were agreed upon between the two parties. It is said that within just two hours, the ten key provisions of the merger, including that it would be a merger of equals and would adopt a new name, were decided. As noted in the description below, once Mandai and Akashi had signed both a memorandum and a written pledge (→Fig. 46aFig. 46c), the merger agreement between Mitsui Bank and Dai-Ichi Bank was concluded in January1943, and Teikoku Bank was established in March. The following year, based on a decision by the Ministry of Finance, Teikoku Bank also merged with Jugo Bank, which had been founded by members of the nobility in 1877.

The Postwar Era

Teikoku Bank began operations as Japan’s largest bank, handling loans to many munitions companies, including those affiliated with Mitsui. However, Japan’s defeat in the war just over two years from Teikoku Bank’s establishment led to its dissolution in September 1948, sparked by demands from the employees of the former Dai-Ichi Bank for separation from the organization. In October of that year, two new entities were created: the “new” Teikoku Bank, centered around employees of the former Mitsui and Jugo banks; and the “new” Dai-Ichi Bank, centered around former Dai-Ichi Bank employees. From the outset of the merger, dissatisfaction had grown among former Dai-Ichi Bank employees regarding raises and promotions, and the emotional friction between them and former Mitsui Bank-related employees proved difficult to resolve.

Subsequently, as Japan’s economy recovered and the former zaibatsu-affiliated banks restored their original names, in January 1954, Teikoku Bank also renamed itself Mitsui Bank, marking a fresh start.

The memorandum regarding the merger between Mitsui Bank and Dai-Ichi Bank, exchanged on December 28, 1942 (opening and closing sections). Mandai Junshiro, Chairman of the Board of Mitsui Bank, and Akashi Teruo, President of Dai-Ichi Bank, formerly advanced their merger negotiations in late December, and on the 27th, visited the Ministry of Finance to propose the merger of the two banks and the establishment of a new bank. In response, the Ministry of Finance stipulated a clause indicating that the Mitsui family must not intervene in management of the new bank in order for the bank to fulfill its “national mission.” Mandai secured prior approval from the Mitsui families and signed a memorandum outlining the merger details, as well as a pledge specifying that the Mitsui family would comply with decisions of the bank’s Board of Directors (→Fig. 46c). In March 1943, under a system with Akashi as chairman and Mandai as president, Teikoku Bank was established, leading to the effective dissolution of Mitsui Bank, which had been Japan’s first private bank and had maintained a dominant position in Japan’s financial sector.