43 Expansion of the Finance Division

Growth of the Corporate Bond Market

Japan in the 1920s saw rapid advances in urbanization, with work done-primarily in major cities-to put in place roads, electricity, gas and other infrastructure. With the development of the electric power industry, there was also a notable expansion in suburban railway lines and the development of residential areas in the suburbs.

After World War I and the depression that subsequently occurred, and amid a sluggish stock market, there emerged substantial demand for capital in industries requiring large-scale capital investment, particularly the electric power and railway industries. Meanwhile, idle capital accumulated at the major banks and interest rates declined sharply, leading to a sudden revitalization of corporate bond issuances. The total of corporate bond issuances in Japan grew from approximately 50 million yen in 1915 to about 630 million yen in 1927. Most of these corporate bonds were underwritten by major banks, supplemented by trust companies and life insurance firms.

Entry into the Trust Business

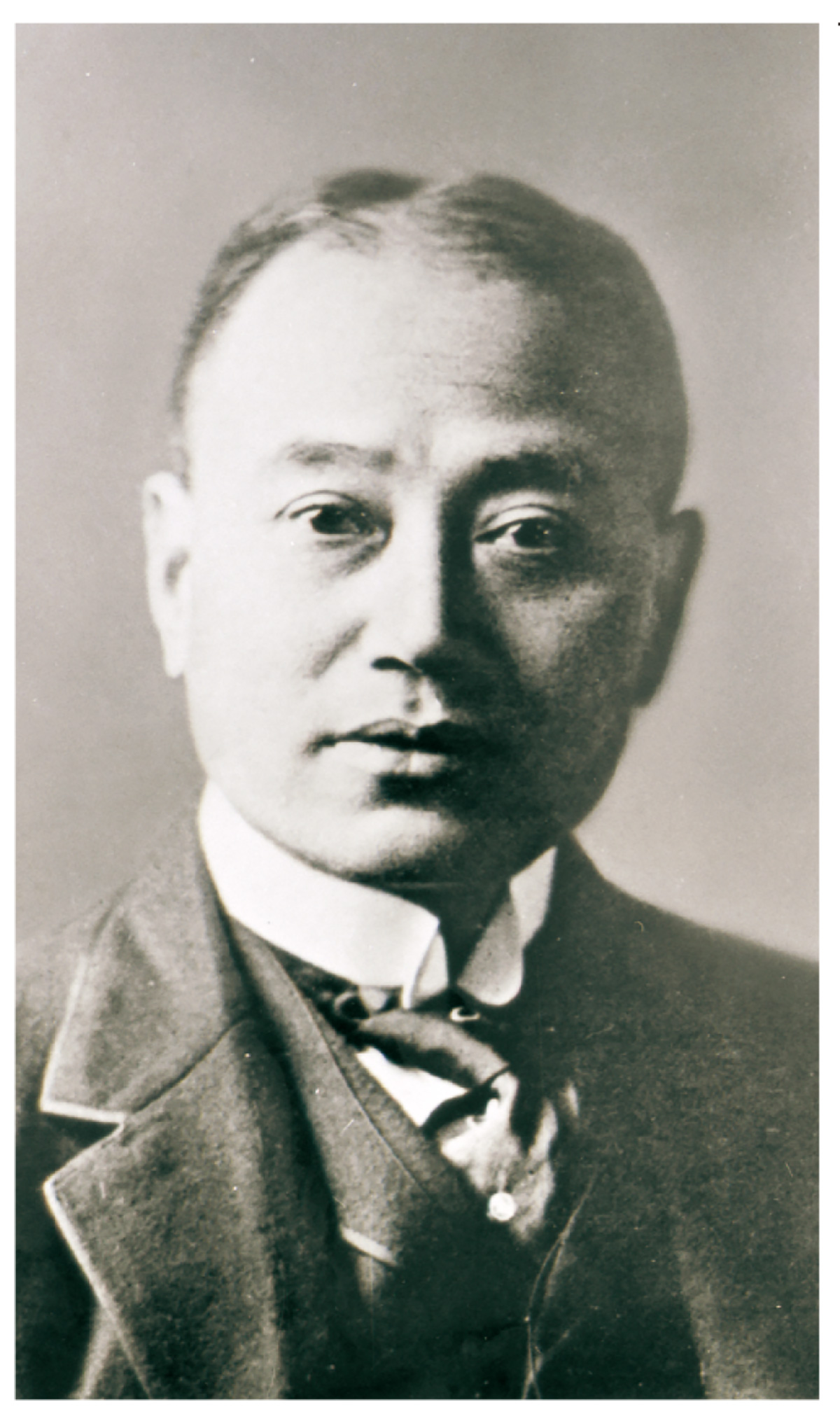

Amid an increasingly active corporate bond market, in 1924 the Mitsui Gomei Kaisha established the Mitsui Trust Co., Ltd. Two years earlier, Yoneyama Umekichi, a managing director at Mitsui Bank (→Fig. 43c) advocated the need for a trust business, based on his experiences abroad in the United States, and together with Dan Takuma, chairman of the Mitsui Gomei Kaisha, began preparations for establishing a trust company. Although the project was initially stalled due to the impact of the Great Kanto Earthquake, with the backing of Dan, who was well-versed in American affairs, Yoneyama hastened to realize the plan and successfully launched the company.

The inaugural general meeting of the firm was held in March 1924 at the Industry Club of Japan. Dan Takuma was appointed Chairman of the Board, while Yoneyama Umekichi, who had resigned from Mitsui Bank, was named Representative Director and President. The company was capitalized at 30 million yen, with the Mitsui Gomei Kaisha holding 144,320 shares out of a total of 300,000 shares, for a 48.1% ownership stake. The total number of shareholders was 332. Among shareholders holding 1,000 or more shares were, in addition to Sumitomo Goshi Kaisha, Yasuda Zenshiro (second generation); Ohara Magosaburo; Nezu Kaichiro, Kagami Kenkichi (of Mitsubishi) and others. In addition, business leaders from outside the Mitsui group joined the company’s board as directors, marking the firm’s start as a public-spirited entity.

Entry into the Life Insurance Business

In the 1920s, public awareness of insurance grew, and an urban middle class-the primary target for insurance-began to form, leading to the rapid development of the life insurance industry. Shortly after the founding of Mitsui Trust in 1926, the Mitsui Gomei Kaisha acquired 20,000 of the 40,000 shares of Takasago Life Insurance, which was in financial crisis, and in 1927 renamed it the Mitsui Life Insurance Co., Ltd. Like Mitsui Trust, this company became a direct subsidiary of Mitsui. In its first fiscal year, supported by Mitsui-affiliated companies, it expanded its customer base and recorded new contracts totaling approximately 20 million yen, surpassing the 19 million yen in contracts inherited from Takasago Life Insurance and marking a significant leap forward for Mitsui’s business.

Contributing to Infrastructure Development

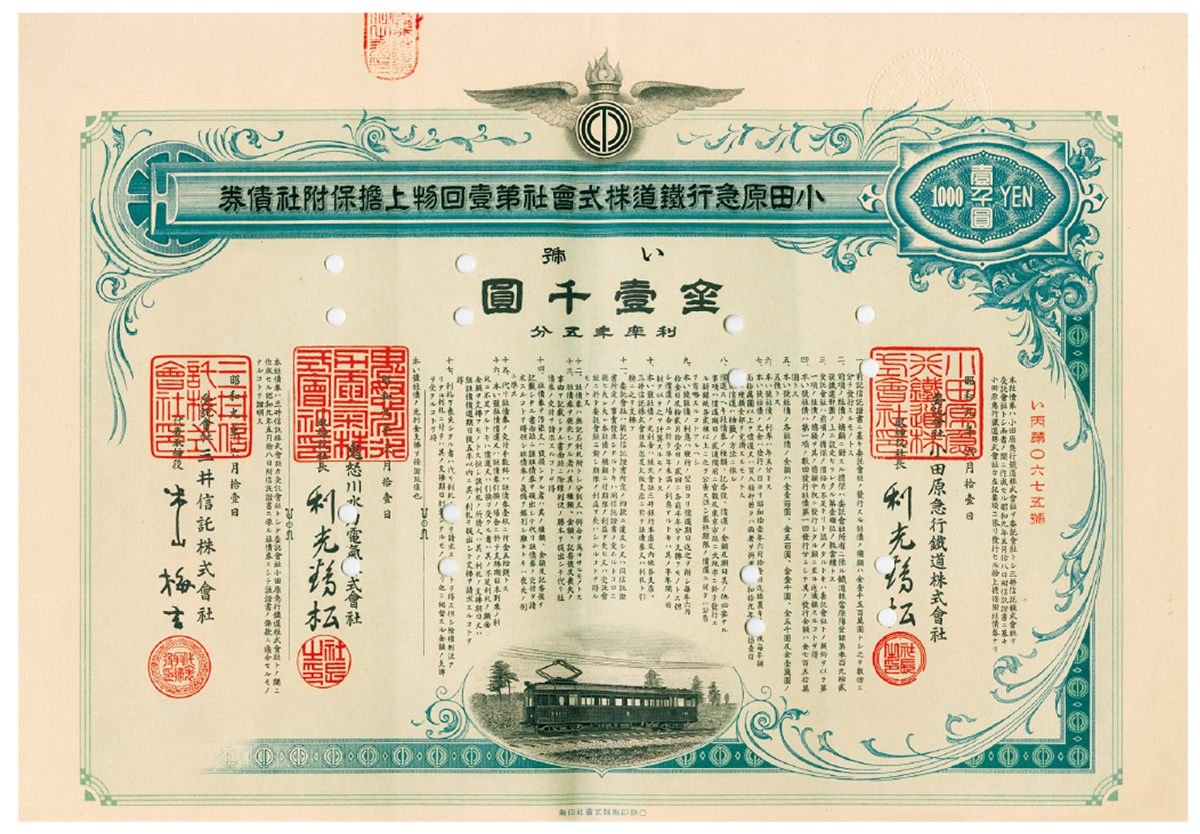

In the 1920s, particularly after the Great Kanto Earthquake in 1923, demand for corporate bond issuances surged, and Mitsui Bank became an active underwriter of such bonds, mainly for electric power companies and electric railways. In 1927, Mitsui Bank’s underwriting accounted for about 16% of corporate (business) bond issues nationwide. Mitsui Trust also raised funds through cash trusts, which offered better returns than term deposits, and directed the majority of these funds into corporate bond investments. Excluding Mitsui-affiliated companies such as Oji Paper, Hokkaido Colliery & Steamship and Denki Kagaku Kogyo, these were primarily investments in electric power companies and railways. Further, the company also expanded into securities underwriting, handling bond issuances for companies such as the Odawara Express Railway (→Fig. 43b). Mitsui Life Insurance also steadily increased its income from premiums, investing these operating funds in stocks and corporate bonds. Again, a high proportion of these investments were directed towards Mitsui-affiliated companies and the electric power and railway sectors. The investment activities and securities underwriting by these three financial arms-Mitsui Bank, Mitsui Trust and Mitsui Life Insurance-thus contributed to the development of infrastructure industry.

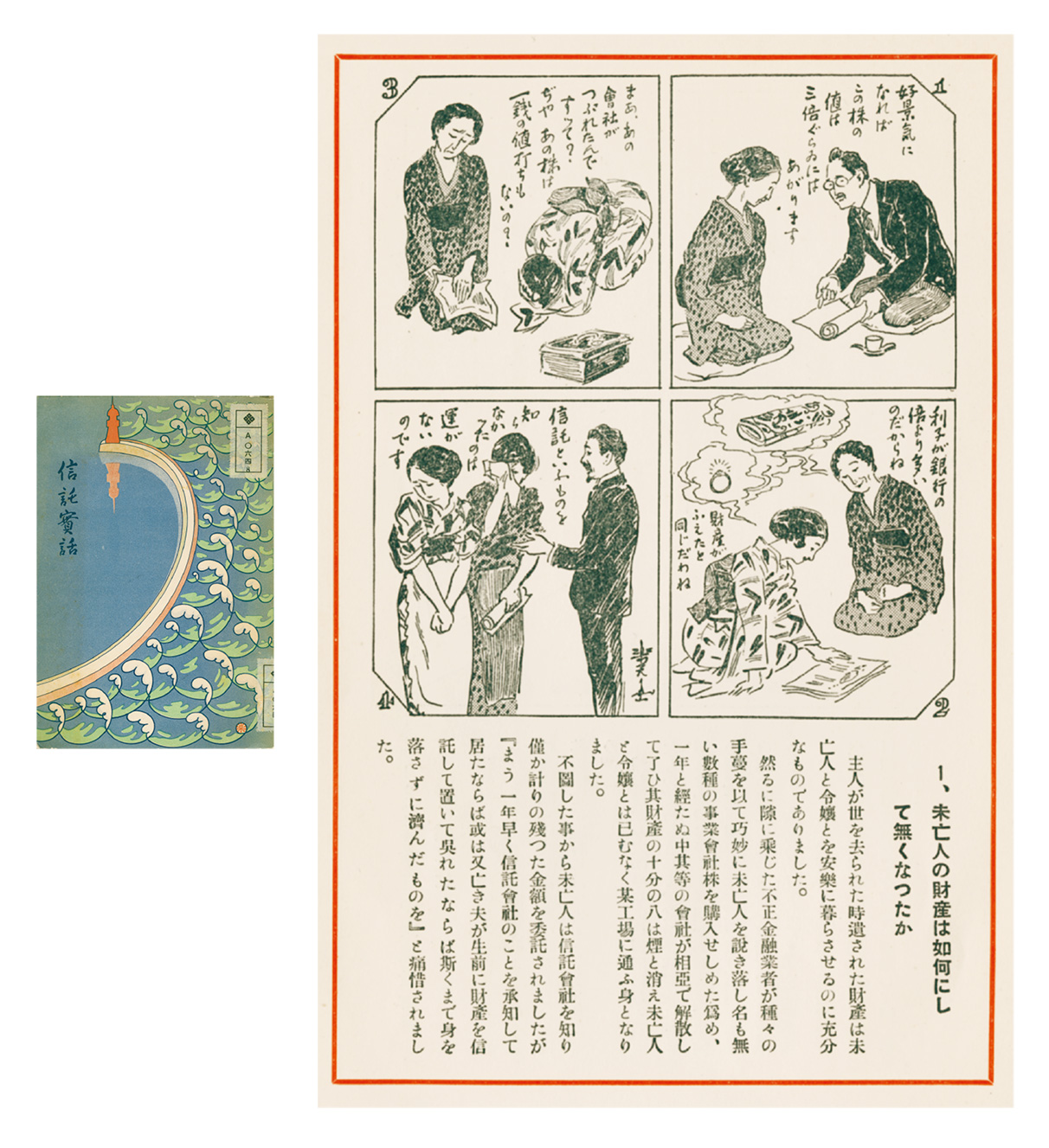

A pamphlet created by Mitsui Trust. Based on a collection of true stories published by a major American trust company, this compilation includes examples from Mitsui Trust. The company also distributed booklets, such as Shintaku no hitsuyo (The necessity of trusts), which clearly explained the benefits of trust services as a tool for managing and investing personal assets. Following World War I, Japan’s economy grew, and although income inequality widened, income levels overall rose. Against this backdrop, the corporate bond market saw remarkable development in 1920s Japan.

Mitsui Trust underwrote the issuance of these bonds in 1934.

Traveled to the U.S. in 1887. After eight years of study, he joined Mitsui Bank in 1897 at the age of 30, and was promoted to managing director in 1909. In 1920, he became the first chairman of the Tokyo Rotary Club, and in 1934, became chairman of the Mitsui Hoonkai Foundation (→45 ). He was thus known as a “man of service.”