29 Management Reforms at Mitsui Bank

Poor Performance at Mitsui Bank

With the founding of The Bank of Japan in 1882, Mitsui Bank, which had relied on government money as its main source of funds, was pressed to convert to a private commercial bank. Under acting deputy vice-president Nishimura Torashiro, the bank had some measure of success in absorbing private deposits, but at the same time, with no system in place for screening loans, loans associated with politicians had begun to accumulate. As of June 1891, no more than about one-third of Mitsui Bank’s total outstanding loans were considered solidly recoverable.

Nakamigawa Hikojiro Appears

Inoue Kaoru (→37), who had come to wield enormous influence on the Mitsui family, felt the situation was critical, and singled out Nakamigawa Hikojiro, then president of Sanyo Railway, to serve as promoter of reforms at Mitsui Bank (→Fig. 29c). Around the time of Inoue’s request to Nakamigawa to join the bank, the Kyoto Branch was struck by a run. In July 1891, a newspaper article came out pointing to Mitsui Bank’s management difficulties, stirring up unrest among depositors in Kyoto. By 6 a.m. the day after the article was published, as many as 60 to 70 people had gathered in front of the branch to demand the withdrawal of their deposits (→Fig. 29b). This uproar led to calls for immediate reforms, even from within the bank. Meanwhile Nakamigawa, mulling over his invitation to join Mitsui, first sought advice from his uncle, Fukuzawa Yukichi. Via telegram, Fukuzawa urged his nephew to immediately accept the offer, and in a letter also wrote, “Mitsui’s credibility should be sufficient to influence all the world’s money.” Arriving in Tokyo on that advice, Nakamigawa joined Mitsui Bank in August, first as director before taking the post of vice-president the following year, putting himself in the position of de facto chief executive officer.

Recruitment of Those with Modern Higher Education, and Bad Debt Consolidation

In carrying out reforms at Mitsui Bank, Nakamigawa aggressively recruited individuals with a modern higher education. He focused especially on pulling in talented graduates of Keio Gijuku, his own alma mater, breathing new life into a management system that had previously centered on servants (employees) of Mitsui. Among those appointed at this time were Asabuki Eiji, Muto Sanji, Hibi Osuke, Kobayashi Ichizo, Fujiwara Ginjiro, and Ikeda Seihin (→45), among others. These men would go on to play brilliant roles not just at Mitsui, but throughout Japan’s business world.

As he was securing the necessary personnel, Nakamigawa first started working on consolidating the bank’s bad debts. In the case of Higashi Hongan-ji Temple, mentioned at the beginning of this article, Nakamigawa proposed registering a mortgage on the temple’s “Trifoliate Orange Villa” (the Shosei-en Garden) and auctioning it off if repayment was not made; he thereby recovered the entire amount of the loan. Other well-known examples of similar forcible collection and consolidation of debts included the 33rd National Bank, which proffered loans based on the influence of Matsukata Masayoshi and Okuma Shigenobu, and Tanaka Seizosho, a company founded by Tanaka Hisashige, a multi-talented inventor, sometimes known as the father of mechanical dolls. In the process, Mitsui Bank acquired both a silk mill and a machine factory (→36).

Streamlining Operations

Further, Nakamigawa also took stringent steps against the bad debts of high-ranking government officials (including Matsukata Masayoshi, Katsura Taro and others), while also, where appropriate, closing branches and sub-branches that had been set up to handle the receipt and disbursement of government funds. In this way, Mitsui Bank was able to break away from the favoritism born of its cozy relationship with the central government, and ultimately, in 1903, relinquish all of its handling of government funds. It also set lending limits, improved compensation for bank employees, and advanced a variety of other measures. In 1898, it dispatched Ikeda Seihin, Yoneyama Umekichi (→43) and others to the West to study bank operations in general, as part of human resource development and efforts to streamline operations. Nakamigawa thus left behind an extremely significant contribution to Mitsui Bank’s foundation as an ordinary bank.

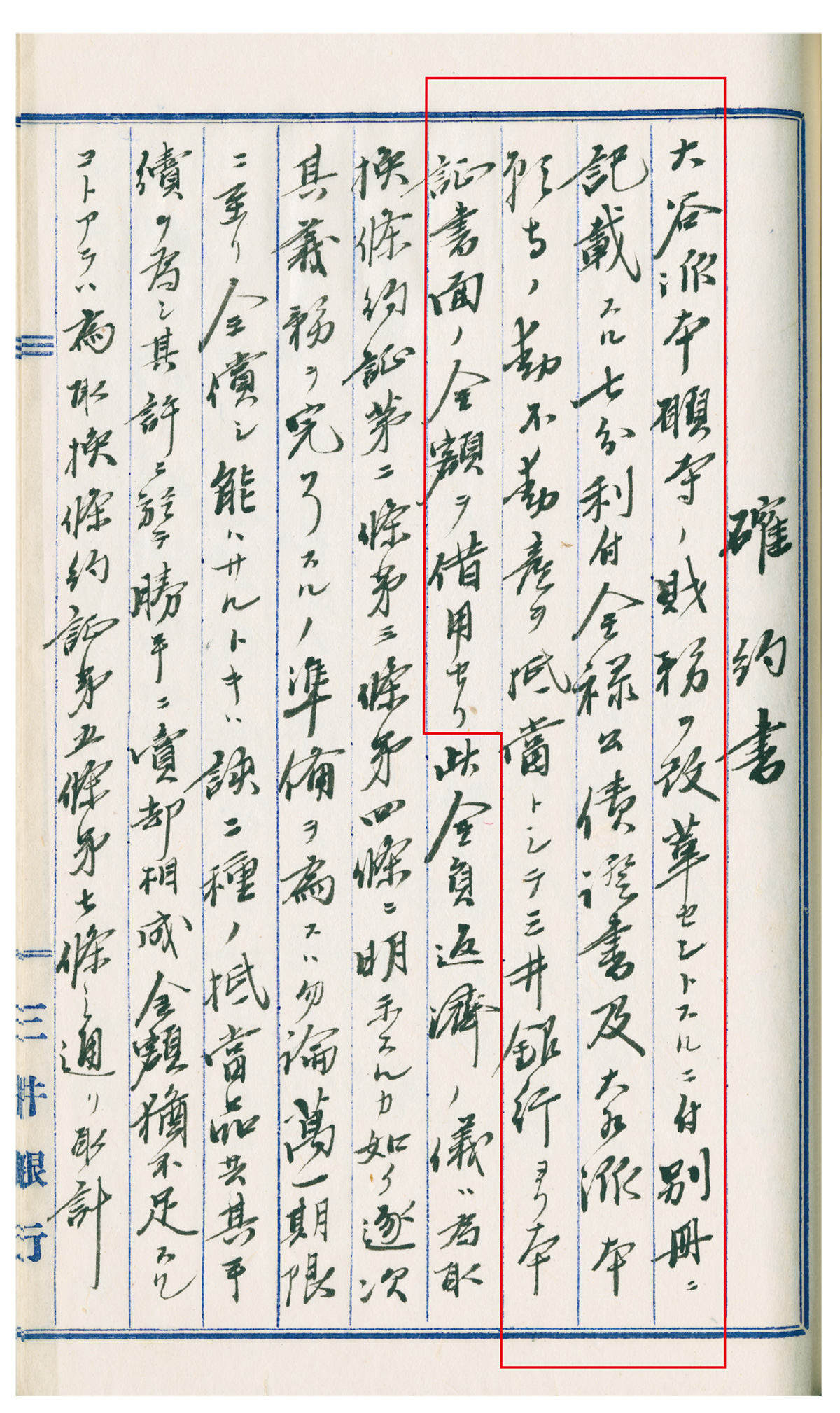

The “Letter of Commitment” at left is a copy (of the opening portion) of a contract entered into regarding a loan agreement Mitsui Bank and Higashi Hongan-ji Temple. In 1885, Mitsui Bank set out to help rebuild the finances of the debt-ridden Higashi Hongan-ji, making the temple a large loan. During the period until the loan was collected, documents related to the finances of Higashi Hongan-ji were submitted to Mitsui Bank, and were later preserved with the Mitsui family.

Description

In December 1885, unable to turn down a request from then-Finance Minister Matsukata Masayoshi, Mitsui Bank lent Higashi Hongan-ji 300,000 yen, while also taking on the responsibility of reforming the temples finances. The above article notes that bond certificates and movable property were to be offered as collateral for this loan.

However, actual revenue at Higashi Hongan-ji continued to fall below plan, and loans from Mitsui Bank accumulated over the years, eventually reaching about one million yen by 1891. This amount represented 10 percent of all loans issued by Mitsui Bank’s main branch at the time. As exemplified by the relationship with Higashi Hongan-ji, in the latter half of the 1880s, Mitsui Bank was still lending based on its cozy relationships with key government officials, and carried a large number of debts receivable with a significant collection risk. Nakamigawa Hikojiro was responsible for the fundamental reforms to this old way of doing business.

Born in Buzen (present day Oita Prefecture) into a family of the Nakatsu clan. His mother was the older sister of Fukuzawa Yukichi. Graduated from Keio Gijuku. After retiring from the Ministry of Foreign Affairs, he founded Jiji Shimpo with Fukuzawa. While exerting his considerable business acumen at Mitsui Bank, he was also a central figure at Mitsui who pushed for industrialization (→36).