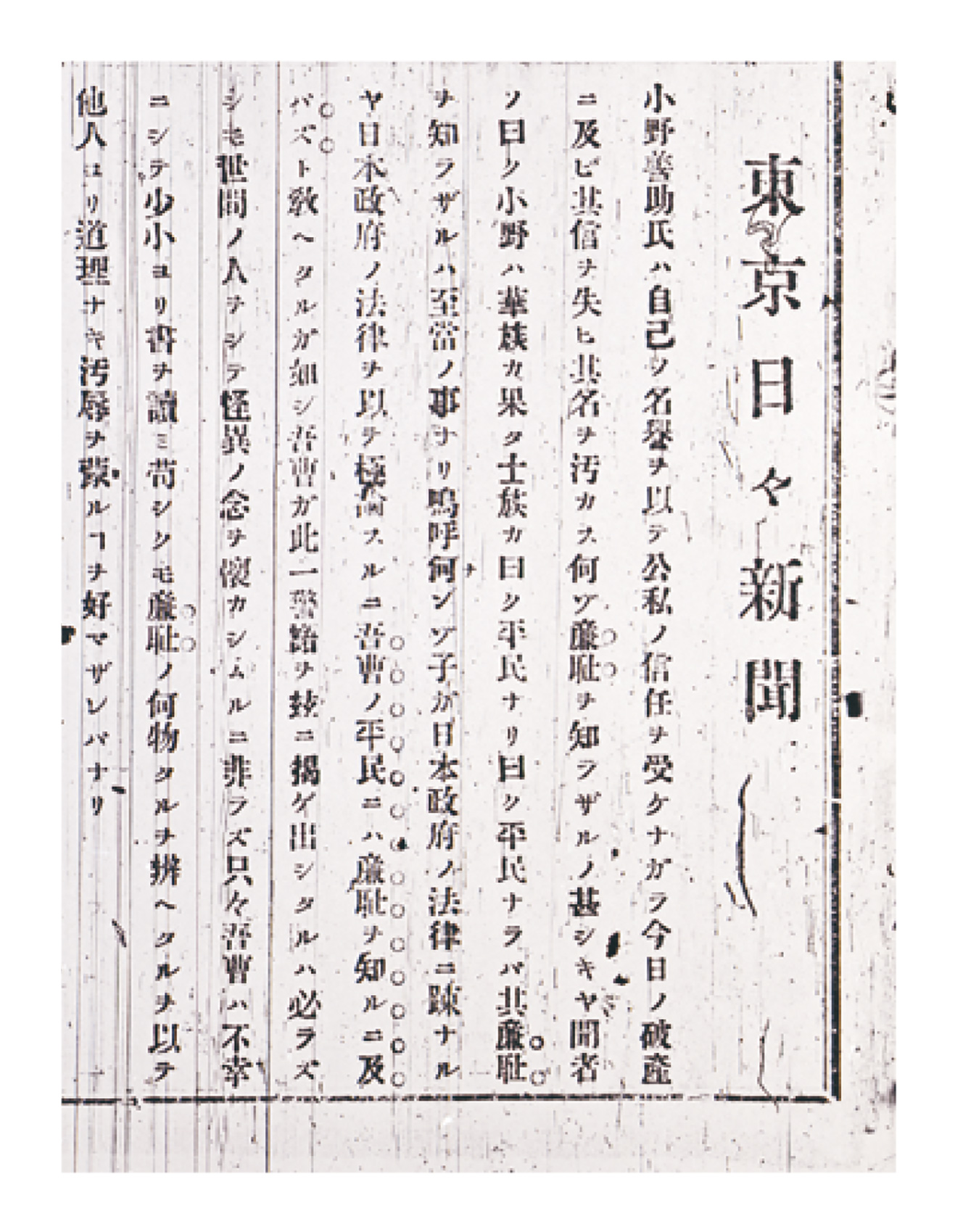

27 The Crisis of 1874

Mitsui-gumi’s Handling of Government Funds

As the Meiji government’s banking system underwent changes, the First National Bank of Japan, founded in 1873, took charge of the Ministry of Finance’s cashiering operations (→25), which had been handled by the Mitsui, Ono and Shimada families engaged in the exchange business (→23). However, the receipt and disbursement of government funds for other ministries and prefectures continued to be entrusted to Mitsui-gumi, Ono-gumi and Shimada-gumi, as in the past. These operations were an important source of funds for Mitsui-gumi, as they allowed them to freely invest taxes and other government funds until they were eventually paid to the government. While Ono-gumi took the lead in handling government cashiering operations in each prefecture, Mitsui-gumi also expanded its branches nationwide, and by July 1873, it was handling the government funds of 13 prefectures.

“Collateral Increase Order”

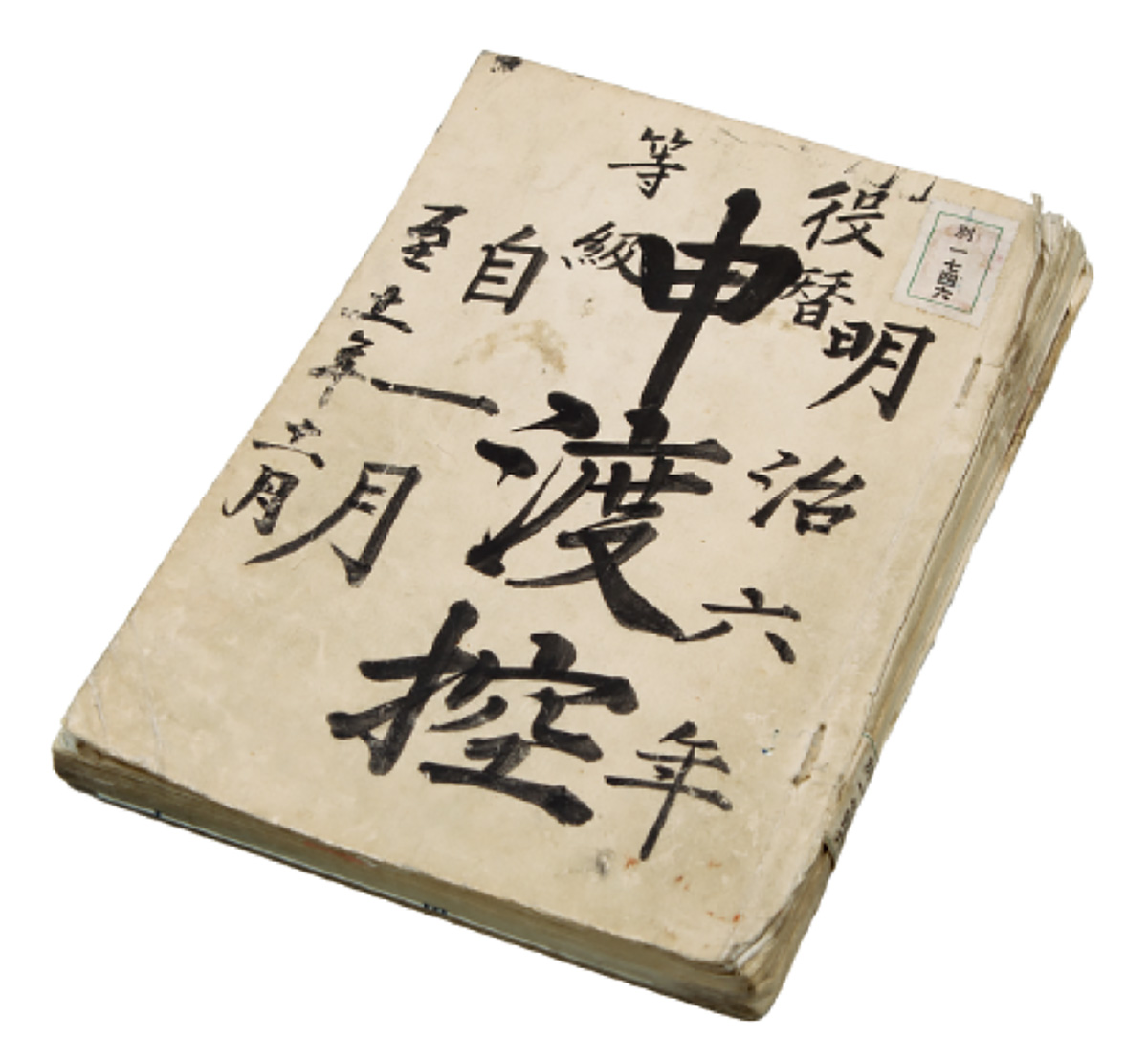

In these circumstances, on October 22, 1874, the government issued its so-called “Collateral Increase Order.” Previously, the moneychangers were to offer collateral equivalent to one-third of the amount of government funds they had on deposit, but with this order, the amount of the collateral was raised to the equivalent of the total of those funds. What is more, the deadline for doing so was set for December 15 of that same year. This shocked the three exchange firms, which had been using government funds on hand to purchase receivables and lend money. Ono-gumi and Shimada-gumi failed in their attempts to raise collateral, and the two closed down in November and December, respectively (→Fig. 27b). In Mitsui-gumi’s case, they were required to pay collateral in excess of two million yen, but the branches had been cavalier in managing their funds, and this increased the amount of overdue loans at branches across the board.

Borrowing from a Foreign Bank

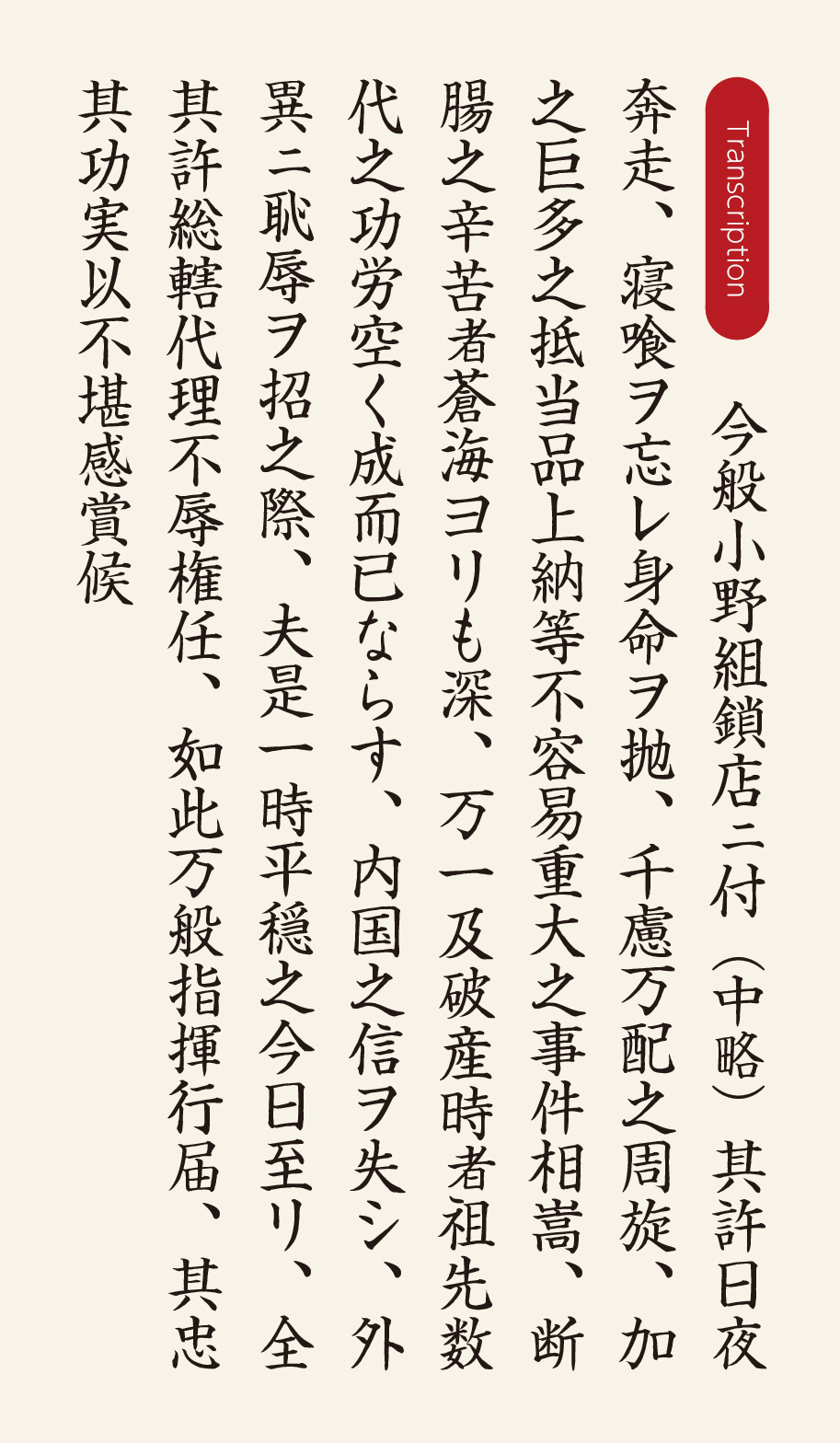

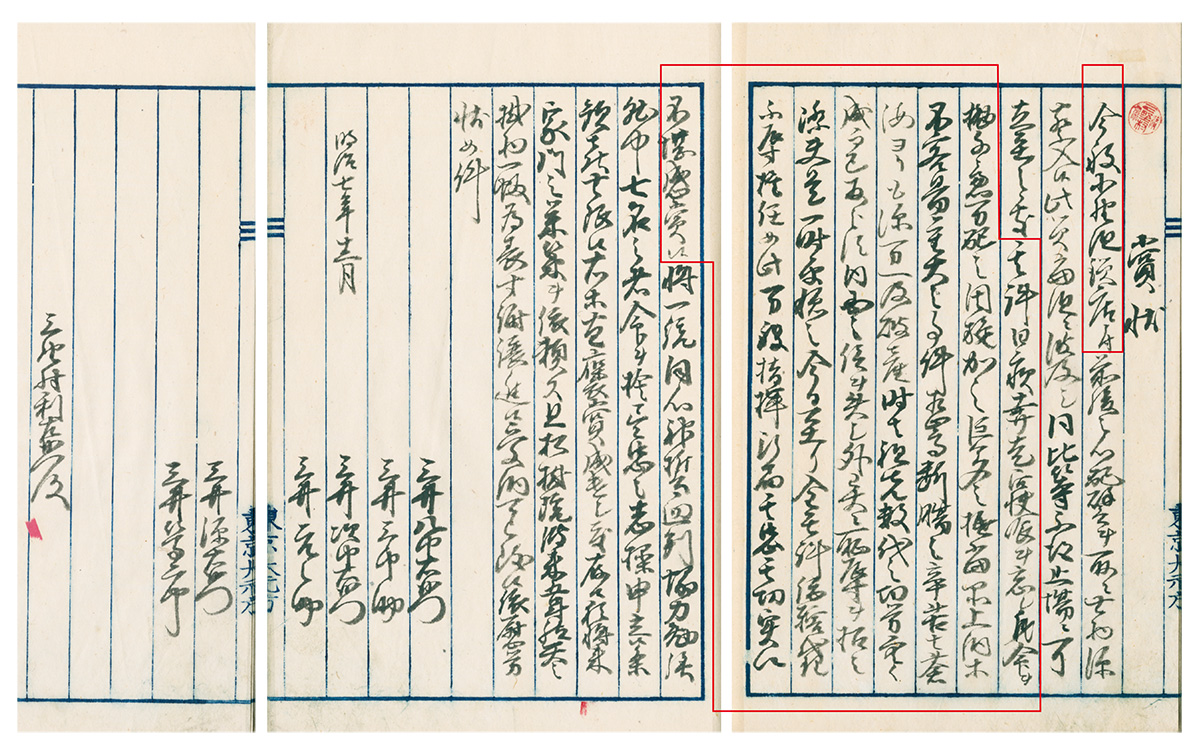

How did Mitsui-gumi weather this difficult situation? This question has long been the subject of endless debate, but recent research has revealed that Mitsui-gumi had borrowed the funds they lacked from the Oriental Bank Corporation (founded in British India in 1842). After setting a large amount of collateral between May and December of 1874, Mitsui-gumi received loans from the bank totaling one million dollars. With this loan, the firm was able to procure public bonds and land certificates and deliver the collateral property by the deadline. It is said that this emergency that required borrowing from a foreign bank was a confidential matter known only to a few people within Mitsui-gumi, because it also involved the risk of a takeover by foreign capital. How hard Minomura Rizaemon and other executives worked to negotiate with the Oriental Bank and gather government-related information can be seen from a letter in which Mitsui family members praised their efforts (→Fig. 27a).

Government Protection

While Mitsui-gumi thus weathered the “Collateral Increase Order” crisis, they now faced a new problem: the repayment of loans. By mid-1875, the company had fallen into a state of significant insolvency, and the now-cancer-stricken Minomura was once again scrambling to make ends meet. The following year, Minomura negotiated with Okuma Shigenobu, the Minister of Finance, to allow the newly established Mitsui Bussan to undertake the export of government rice and divert the proceeds from the exports to repay the loan from Oriental Bank. While it managed to avoid bankruptcy, Mitsui-gumi was ultimately forced to rely on generous protection from the government.

A copy of appointments and certificates issued to Mitsui-gumi executives, prepared by the Omotokata. This document was written in December 1874, and is an expression of gratitude to Minomura Rizaemon from Mitsui Domyo. The senders are all Mitsui Domyo, from right to left: Mitsui Takayoshi (Kita family), Takayoshi (Koishikawa family), Takaaki (Kita family), Takashige (Isarago family), Takatoki (Shinmachi family), and Takakiyo (Nagasakacho family).

Translation

Ono-gumi has gone bankrupt. You (Minomura) have worked hard, scrambling to mediate on our behalf, forgetting even to eat or sleep. However, you also suffered enormously from the difficulty of having to pay over to the government a huge amount in collateral goods. Had the company gone bankrupt as a result of this crisis, it would not only have undone the hard work of several generations of our ancestors, but would have brought shame to the company as a Japanese merchant. The fact that we have arrived at this day of tranquility is the result of your well-directed leadership, and we commend you for your loyalty and filial piety.

Description

When Ono-gumi went bankrupt in 1874, Mitsui-gumi was facing a crisis of similar proportions. This letter is the ultimate expression of gratitude to Minomura and the other executives for their hard work. The document is addressed to a total of eleven individuals, including Minomura Rizaemon, as well as Nishimura Torashiro and Minomura Risuke (the adopted heir of Minomura Rizaemon).